An investor and strategic partner

Haddington invests in entrepreneurial businesses with management teams which have the skills to create and grow world-class energy projects and companies.

A history of forward thinking infrastructure investments

The Origin

Managing Directors, Chris Jones and John Strom, co-founded TPC Corporation, a midstream operating company with three business lines—natural gas marketing, storage, and gathering and processing. Scott Jones later joined the company in 1992.

End of A Chapter

After having grown the revenues to $700 million, TPC was sold to PacifiCorp in 1997. Together, they completed over $175 million of midstream acquisitions and developed another $226 million of midstream assets.

A New Beginning

The team then applied that experience to investing private capital in the midstream energy sector with the formation of Haddington Ventures in 1998.

Haddington Energy Partners III

In the third fund called HEPIII, Haddington Ventures acquired the rights to the only known “domal” salt formation in the Western U.S. with the intention of developing a series of energy storage businesses through the Magnum Development portfolio company.

Haddington Energy Partners IV

As part of HEPIV, Haddington Ventures entered the critical minerals recovery business with the acquisition of Eureka Resources, as well as long-duration energy storage and production with APEX Compressed Air Energy Storage.

ACES Delta

Magnum Development forms the ACES Delta joint-venture with Mitsubishi Power Americas, to develop a hydrogen production and storage hub on the Magnum salt dome.

The Present

Haddington Ventures raised the Equity Syndication Program (ESP) to support the worlds largest green hydrogen hub at ACES Delta. ESP has an initial commitment of $650M with investment expansion rights up to $1.5B.

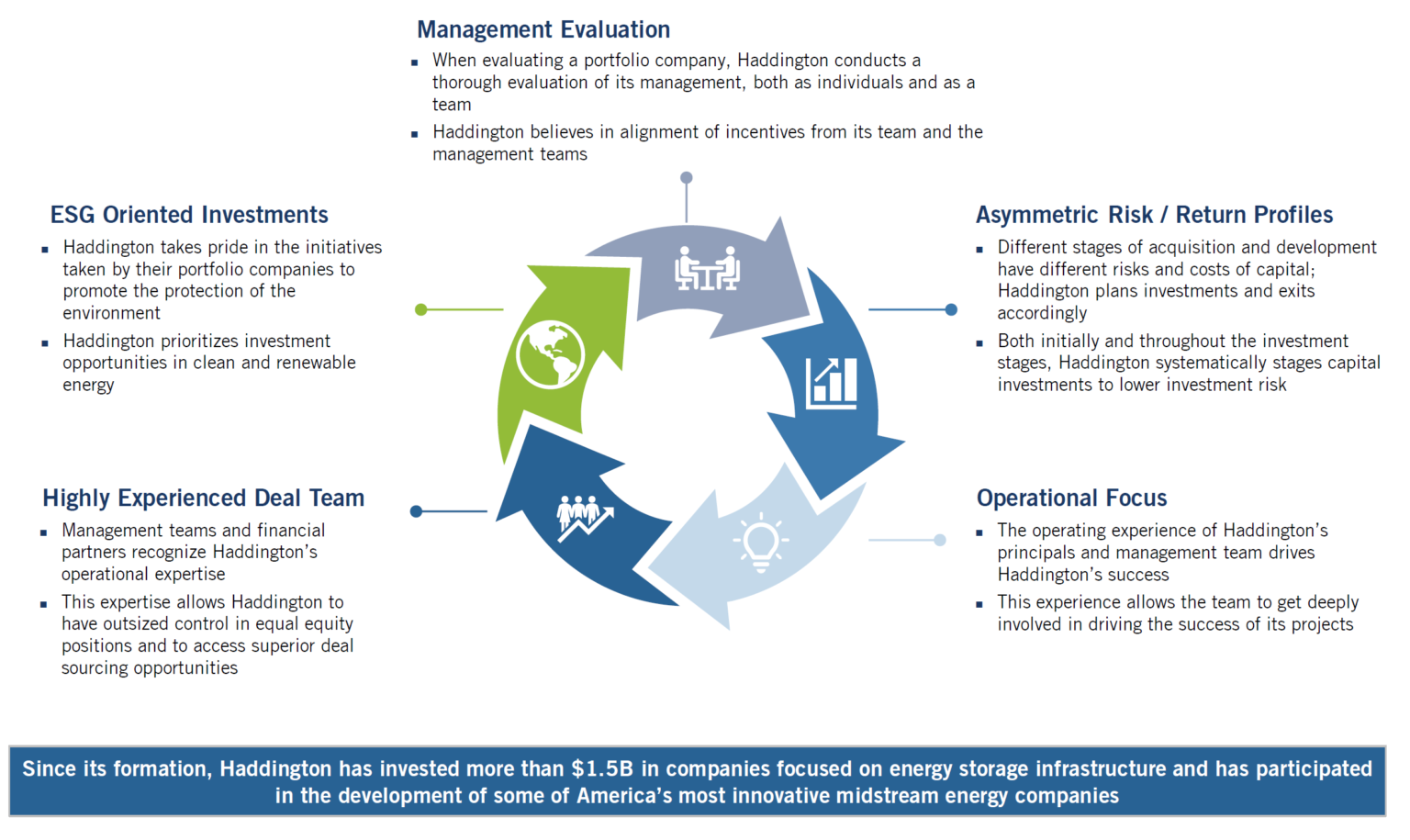

Our Core Values